Michael Thomas Robinson II, Certified Estate & Trust Specialist

Navigating The Path to Peace and Abundance;

Financial and Material Well-Being for You, and Your Loved Ones.

Michael has served as a trusted advisor to individuals, families and businesses for over two decades. Michael focuses on the three most important areas of planning: educating clients, asking the right questions, and providing clients with individually tailored options, strategies and recommendations to achieve their specific goals and objectives.

Over the decades Michael has given thousand of talks on the importance sound planning can play in the lives of you and your loved ones both now and well into the future. Your family's peace and abundance is of the utmost importance to Michael.

His focus is on building long term relationships built on trust, commitment and integrity. Michael brings a level of experience to estate planning, financial planning and the life planning process that are unique, insightful and powerfully life-changing.

Estate Planning

Trust

Financial & Retirement Planning

Commitment

Business Continuation & Exit Strategies

Integrity

Client Centered Planning.

Your Peace Of Mind Is The Goal.

Estate Planning

For the ones you love.

There are fifteen key areas of estate planning, that should be considered in the design of your estate plan, significant tax reduction and Probate avoidance being only two of them.

Whether you simply own a home that you would like to pass on to children or grandchildren, or have a more complex estate, taking the time to plan, now, saves your family time , money and potential headaches in the future. Thus, ensuring a smooth transition of your assets to your loved ones in the future.

Consider this: of the 33 million wealthiest households in America that are estimated to control $13 trillion in wealth, only 18% have a valid financial or estate plan .

Financial Planning

Trusting Your Instruments.

Creating your financial plan provides the road map to navigate the path to your financial and material well-being. Providing clarity and confidence that you will reach your financial goals and objectives.

Surveys show that six out of ten Americans are without a financial plan.

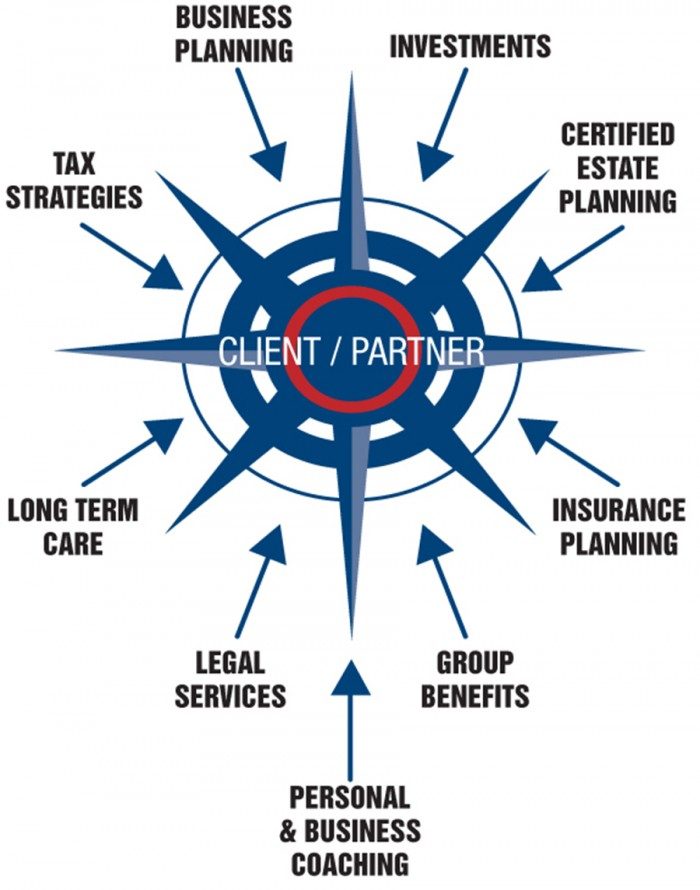

Integrated Strategic Planning

Preserve, Protect and Perpetuate Family Wealth, Values, Principles and Traditions Now and Into The Future*

Integrated Estate & Financial Planning requires the strategic consideration of income and estate tax issues, property tax base exclusion and transfer planning issues (in CA), the proper use of insurance, the implementation of financial and retirement planning, and the proper planning for distribution to your intended beneficiaries of your estate. Unbeknownst to many, distribution requires the most effort in designing an estate plan.

Michael will work closely with your tax, insurance, financial and legal professionals to create an Integrated Estate and/or Financial Plan tailored to your needs and specifications. Michael will carefully and thoroughly review your unique circumstances, design and implement your personally designed estate and/or financial plan, as well as other advanced planning techniques.

In regards to your estate planning, Michael will guide you step-by-step through the issues of trustee, successor trustee and guardian selection, the proper titling of property and the coordination of different planning strategies. And last and most importantly, Michael will work closely with you to see to that the proper funding of your assets, to any trusts created, is carried out until completion.

(D.Andrews)

The Fifteen Areas Of Estate Planning

Experience has shown that there are fifteen areas of estate planning that should be taken into consideration in order to develop a sound foundation for designing and implementing an estate plan. These are: Supplemental Planning, Settlement, Cost/Probate Avoidance, Money Management, Guardianship/Conservatorship/Special Needs, Distribution, Asset Protection, Estate Reduction & Freezing, Asset Allocation & Conservation, Income Tax Planning, Social Capital, Insurance Planning, Retirement Distribution, Business Succession, and Medicaid Planning.*

Ancillary Planning Strategies

1. Supplemental Planning. Supplemental planning consists of ancillary planning strategies to cover events that may occur prior to one’s death. These documents are:

a. Durable Power of Attorney

b. Advanced Health Care Directive / Living Will (Terry Shiavo)

c. Organ Donation

d. Advanced Health Care Directive for Minor Children

e. Nomination of Conservator

f. Medicaid Planning.

Estate Settlement and Probate Avoidance

2. Settlement. At death, there is a tremendous amount of paperwork required in a short period of time. It’s important to eliminate most of the paperwork while you are alive and minimize the rest.*

3. Cost/Probate Avoidance. Unfortunately, death or incapacity can sometimes be costly. Some costs can be eliminated and others minimized, such as avoiding a court appointed conservatorship/guardianship, federal estate taxes, state inheritance taxes & the costs associated with probate.

4. Money Management. Money Management for estate planning purposes relates to the establishment of a management team to assist your surviving spouse or heirs in the management of your assets after your death.

Guardianship-Conservatorship-Special Needs Planning

5. In the event both parents were to pass, without having the adequate planning in place, leaving behind a minor child or children under the age of 18, or an adult child who is above 18 with Special Needs, and/or has been deemed unable to care for oneself by the state, guardianship issues arise. Without proper planning, for example, the state will appoint a person (maybe someone whom you did not intend to be the guardian) who will be the guardian of the minor as well as a person to be guardian of the estate (money). The guardian’s responsibility is to take care of the minor children; showing love, affection and providing support and safeguarding. Additionally, the state will appoint a conservator of the estate. This person’s responsibility is to manage the moneys for the minor(s). If the guardian needs additional money, they have to petition the court, thus generating additional court costs and attorney fees.

The worst part of guardianship occurs when the minor becomes an adult. In many cases, at age 18, they would likely receive their inheritance outright. Most parents believe age 18 is much too young.

Distribution Strategies

6. Distribution. Distribution outlines who gets what, when, and how much; taking into consideration premature death of heirs, divorce and sibling rivalries. These are real life issues that should be addressed but are often overlooked by planners. Unbeknownst to many, distribution requires the most effort in designing an estate plan.

7. Asset Protection. Asset protection focuses on protecting your assets from predators and creditors in the event of a lawsuits or bankruptcy. Asset Protection is often one of the most misunderstood parts of an estate plan, and is often never adequately addressed. This same planning strategy can also be used to protect assets for future generations.

8. Estate Reduction and Freezing. Often times you cannot control the growth of an asset. Estate freezing is an advanced planning technique that allocates assets so that the growth of the asset(s) takes place outside the estate rather than within the estate. Additional planning strategies can reduce the value of an estate; thus, reducing the impact of potential estate taxes.

9. Asset Allocation & Conservation. Asset allocation identifies assets to be sold to pay debts or federal estate taxes without incurring additional income tax. Conservation is accomplished by preselecting assets to retain for future generations.

10. Income Tax Planning. Pre or post retirement income & estate tax planning. Reviewing or establishing a qualified plan to receive tax deductible contributions to reduce your current income tax on excessive income not being used to live on.

Social Capital-Charitable Giving Strategies

11. Social Capital. The portion of the estate that is paid to Uncle Sam in the form of estate and income tax. In 1969, the IRS authorized a special type of trust that gives the taxpayer a choice in redirecting social capital (estate/income taxes) to a worthwhile charitable organization in the community.

12. Insurance Planning. A). Long Term Care: largest segment of aged 50+ individuals in U.S. history. B). Umbrella insurance: O.J. Simpson. C). Health insurance: a long term illness could wipe out savings. D). Disability: a greater chance of disability than death. E). Life Insurance: income replacement, estate taxes, eliminate debt, and etc.

13. Retirement Distribution. Exploring the different strategies available that can prolong the distribution of retirement assets for multiple generations to reduce income tax.

14. Business Succession. There are over 500 different combinations in transitioning out of a business. Knowing the difference between time and timing is very important. A) Time – preparing the business and its owner for the transition; b) Timing – transitioning out of the business when the business has obtained its optimum value.

15. Medicaid Planning: Prepare an estate plan to preserve as much of one’s estate in case Medicaid planning is needed.

Integrated Strategy Driven Estate Planning *(D.Kestel.TEAG)*(B.Lee.Ebusconsulting)

More Fully Understanding Our Relationship With Money

Sound Planning May Be Worth More Than A Lifetime of Work

We tend to live in a time starved society. How many times have we found ourselves or our loved ones saying, " I don't have time". Have you ever taken a moment to considered that taking the time to plan now may be worth more than a lifetime of work?

Women And Money

The Wisdom of Understanding

Six in ten women are their family's primary bread winner according to the Women, Money and Power Study.

How we cultivate a healthy relationship with money as an energy exchange, a sense of clarity with our financial state, open conversations with our family about our ability to sustain and to grow in abundance, can be invaluable.

Our relationship with money plays an integral role in our arriving to the state of financial and material well-being .Our relationship with money effects, for better or worse, our, vitality, our, mental, physical and emotional well-being.

Knowledge can lead to understanding. Wisdom, however, comes from experience. Empower yourself today by taking the time to complete your financial or estate planning. Exchange the fear of uncertainty with the wisdom of understanding.

Understanding Abundance:

Money and Purpose

Holistic Financial & Estate Planning

Financial security is just one part of the happiness equation. Having a clear understanding of abundance is instrumental in leading a prosperous, harmonious, and balanced life. If we can't define it, how will we ever know if we can or have already attained it?

Abundance can be defined as: an ample quantity: affluence, wealth: relative degree of plentifulness. Merriam Webster Dictionary

In my professional experience as an estate and financial planner, these definitions seem too elusive, too nebulous. Even when one is financially affluent, it has been my experience that monetary wealth alone doesn't lead to a full, harmonious, balanced and/or happy, healthy life.

Imagine the image of a wheel with twelve spokes. Each equally supporting the other. When they are aligned properly, you have a smooth ride; they are in harmony.

Contemplate for a moment, abundance as having twelve qualities each flowing in harmony with the other. You have a smooth ride. The road of life, however, gets bumpy at times. Should one of the spokes of the wheel become weak or break, your smooth ride becomes rough and imbalanced.

If living more fully in abundance is of interest to you, your spouse or partner, a friend or family member, Michael will help. He will guide you through the process of taking a deep look at your relationship with money, your financial situation, to look at what drives your decisions, what your true goals are and how to align your financial or estate planning with your missions, principles and attitudes toward money.

Leaving Footprints

Planned Giving:

The Virtue of Generosity

Surveys done among older people show that most of them wished they had done more, with the time they spent on Earth to leave a behind a legacy or a force, for the good of all.

This can be as simple as making gifts of cash, stocks, bonds or other highly appreciated assets, to the charitable organization(s) of your choosing, either while you are alive or at death through your trust(s). However, for more complex estates there are various advanced estate planning techniques that can be tailored to meet each clients unique circumstances, goals, missions and estate and family objectives. If this is of interest to you, Michael can show you how others have addressed this issue. There are many ways to do this.

Contact

Telephone: +1 213-478-1153

E-mail: michael.ebusconsulting@gmail.com

Serving You In Person In Greater Los Angeles & Southern California. Working Remotely With You Around The Country: 46 Peninsula Center, Ste. 117, Rolling Hills Estates, CA 90274

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.